How to do Payment Gateway Integration – Whether you run an eCommerce platform or are just keeping your website up to date, you should provide a quick, simple, and safe payment option for your clients. The payment method you use must meet the needs of your clients as well as your company. It must therefore be safe from fraud, compatible with your platform, allow several payment methods, and be easy to use.

A merchant employs a payment gateway in order to process credit or debit cards and accept electronic payments. The currencies you can accept, the transaction cost, the time it takes for money to enter your merchant account, and the payment options you’ll offer are all influenced by your choice of payment gateway.

Over 23 percent of shoppers give up on their shopping carts due to complicated checkout procedures (11 percent) or a checkout process that requires too much information (12 percent), according to Invespcro.com. These figures attest to the fact that selecting the best payment solution supplier is just as crucial to a successful eCommerce website as selecting other elements. But first, we must comprehend what a payment gateway is and how it operates before we can select a payment option.

Payment Gateway Integration & What is a payment gateway?

Payment Gateway Integration – An online and physical store’s payment gateway is a service that authorizes and handles payments. A gateway acts as a conduit to ease the flow of transactions between buyers and sellers. To transfer the transaction data securely, it makes use of encryption and security protocols. Payment processors, banks, and mobile devices receive and send data back and forth.

The following transaction types can be carried out using payment gateways:

- Authorization – a kind of transaction that determines whether a client has sufficient money to make a purchase. It excludes the actual financial transfer. Rather, a merchant verifies that a cardholder is able to pay for an ordered item during authorization. For orders that require a longer manufacturing or shipping period, an authorization transaction is used.

- Capture – the process by which a previously approved payment is actually processed and money is transferred to the merchant’s account.

- Sale – a conglomeration of transactions including capture and authorization. Initially, a cardholder is authorized. Then, money might or might not be taken in. It’s a standard payment for one-time purchases like e-tickets or subscription payments.

- Refund – The outcome of an order that is canceled; in order to get the money back, the merchant must execute a refund payment procedure.

- Void – akin to a refund, but possible in cases where money hasn’t been collected yet.

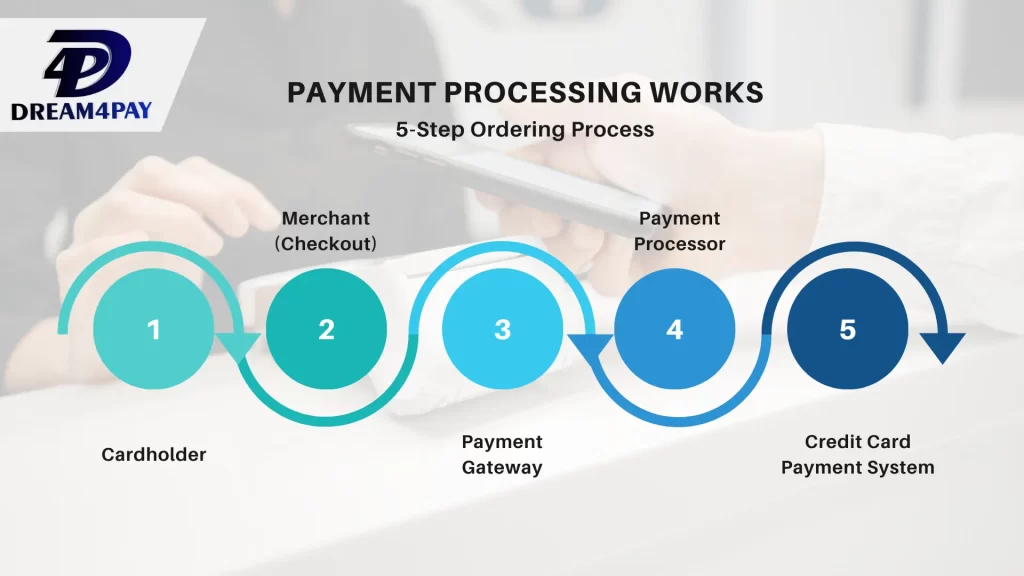

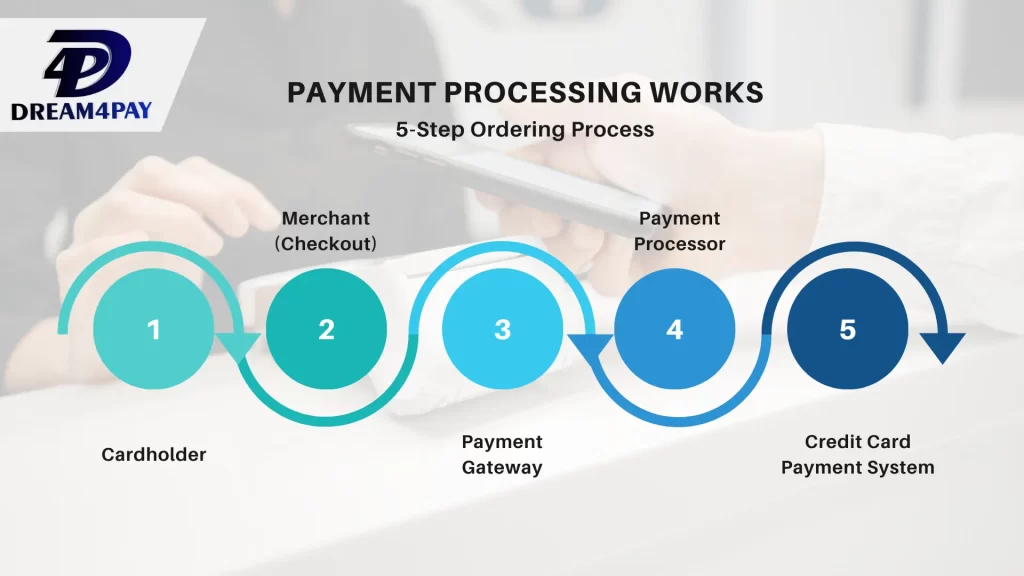

Payment Gateway Integration & Payment processing flow

It may surprise you to learn that the infrastructure supporting online payment processing is somewhat more intricate. The customer must navigate through a tiny window or a different website to complete the checkout process. However, the buyer can finish the purchase in a matter of seconds since multiple financial institutions, or tools, are involved in the processing, which verifies the transaction data on both sides.

Upon a customer’s checkout, a payment gateway must process multiple jobs that need around 3–4 seconds, including the card number, expiration date, and CVV.

- Customer- After selecting the “Purchase” button and completing the required fields, the customer submits the transaction data. Through an SSL connection, the encrypted data is transmitted to the merchant’s web server.

- Merchant and payment gateway– A merchant receives the transaction data and sends it over another encrypted SSL channel to the payment gateway. In the event that a payment gateway stores any data, such data is settled in a particular kind of safe storage. Typically, gateways save tokens instead of actual credit card numbers.

- Processor of payments- The payment processors receive the information. These are the businesses that act as third-party participants and offer payment processing services. Payment processors communicate back and forth with payment gateways and merchant accounts via data transfers. At that point, the transaction is being forwarded to a card network (Visa, Mastercard, American Express, etc.) by a payment processor.

- Visa/Mastercard/American Express/Discover- Verifying transaction data and forwarding it to the issuer bank—the financial institution that created the cardholder’s credit or debit card—is the responsibility of a card network.

- Issuer Bank– The authorization request is also approved or denied by the issuing bank. The payment processor receives a code from a bank that comprises information about the error or the status of the transaction.

- Portal for Payments– The website receives the transaction status once it has been returned to the payment gateway.

- Customer and Issuing bank– Via a payment system interface, a customer receives a message indicating whether the transaction was approved or rejected.

- Issuer Bank– The money is deposited to the merchant’s account in a few days, usually the following day. The issuing bank completes the transaction with the acquiring bank.

Payment Gateway Integration – We are now getting closer to the range of payment gateways. You must take a few steps in order to integrate a payment system into your website.

Payment gateway integration

Payment Gateway Integration – Generally, there are four main methods to integrate a payment gateway. All of them differ by two major factors:

- whether you must be in compliance with any financial regulation (PCI DSS), and

- the degree of user experience concerning the checkout and payment procedure.

So let’s discover what the options are here and which integration methods suit your needs.

What is PCI DSS compliance and when do you need it?

Payment Gateway Integration – In case you just need a payment gateway solution and don’t plan to store or process credit card data, you may skip this section, because all the processing and regulatory burden will be carried out by your gateway or payment service provider.

Payment Gateway Integration – But in case you’re going to deal with sensitive financial data, you’ll need to comply with some industry regulations. Payment Card Industry Data Security Standard (PCI DSS) is a necessary element for processing card payments. This security standard was created in 2004 by the four biggest card associations: Visa, MasterCard, American Express, and Discover.

To become PCI compliant, you will have to complete 5 steps:

- Define your compliance level. There are four levels of compliance that are determined by the number of safe transactions your business has finished. Transactions count if they were done via MasterCard, Visa, American Express, or Discover cards, and there was a certain number of successful transactions.

- Study the PCI Self-Assessment Questionnaire (SAQ). SAQ is a set of requirements and sub-requirements. The latest version has 12 requirements.

- Complete the Attestation of Compliance (AOC). AOC is a kind of exam you take after reading the requirements. There are 9 types of AOC for different businesses. The one required for retailers is called AOC SAQ D – Merchants.

- Conduct an External Vulnerability Scan by the Approved Scanning Vendor (ASV). The list of ASVs can be found here.

- Submit your documents to the acquirer bank and card associations. The documents include the ASV scan report and your filled-in SAQ and AOC.

Payment Gateway Integration – Given this information, we’re going to look at the existing integration options and explain the pros and cons of each. We’ll also focus on whether you must comply with PCI DSS in each case as we explain what integration methods suit different types of businesses.