Demystifying Payment Gateway MID: A Comprehensive Guide

Introduction:

Dream4pay will explain Payment Gateway MID – In the digital era, where online transactions have become the norm, understanding the intricate workings of payment gateways is crucial for businesses and consumers alike. Among the myriad of technical terms associated with online payments, one often encounters the acronym “MID,” which stands for Merchant Identification Number. In this blog, we’ll delve deep into the realm of Payment Gateway MID, deciphering its significance, functionality, and the best practices associated with it.

Understanding Payment Gateway MID

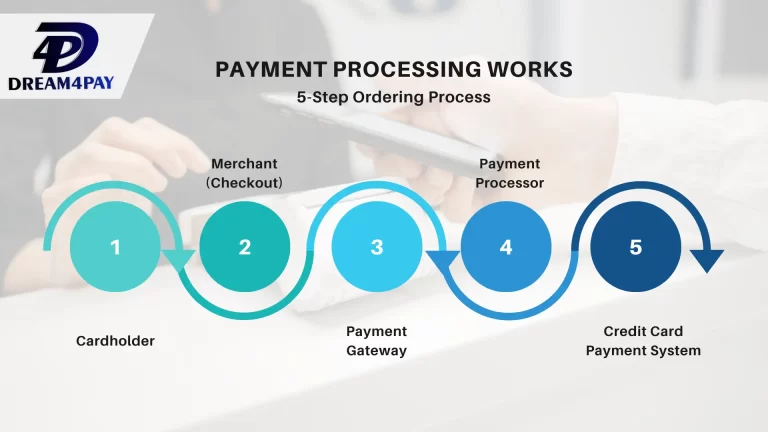

To grasp the concept of Payment Gateway MID, let’s start with the fundamentals. A payment gateway serves as the intermediary between the merchant’s website and the financial institutions involved in processing a transaction. When a customer makes a purchase online, the payment gateway securely captures the payment details, verifies them, and facilitates the transfer of funds from the customer’s account to the merchant’s account.

Now, where does the MID come into play? The MID, or Merchant Identification Number, is a unique identifier assigned to each merchant by the payment gateway provider. It serves as a means of distinguishing one merchant from another within the payment gateway’s system. Think of it as a digital fingerprint that identifies and tracks transactions associated with a specific merchant.

Importance of Payment Gateway MID

The significance of Payment Gateway MID extends beyond mere identification. Here’s why it’s crucial for merchants:

- Transaction Tracking: The MID allows merchants to track and reconcile transactions efficiently. By associating each transaction with a unique MID, merchants can easily identify and reconcile payments, simplifying accounting processes.

- Risk Management: Payment gateway providers utilize MIDs to assess the risk associated with each merchant. By analyzing transaction data associated with a specific MID, providers can identify patterns indicative of fraudulent activity or chargebacks, enabling them to implement appropriate risk management measures.

- Settlement: MIDs play a vital role in the settlement process. Funds from customer transactions are deposited into the merchant’s account based on the MID associated with the transaction. This streamlined approach ensures accurate and timely settlements for merchants.

- Customization: MIDs offer merchants the flexibility to customize their payment processing preferences. For instance, merchants may have multiple MIDs for different product lines or business divisions, allowing them to tailor payment processing parameters according to specific requirements.

Best Practices for Managing Payment Gateway MID

Now that we’ve established the importance of Payment Gateway MID, let’s explore some best practices for effectively managing MIDs:

- Maintain Compliance: Adhere to the guidelines and regulations set forth by the payment card networks (e.g., Visa, Mastercard) regarding MID usage and security protocols. Compliance with industry standards ensures the security and integrity of payment transactions.

- Segregation of Transactions: If applicable, segregate transactions across multiple MIDs based on factors such as product type, geographic location, or sales channel. This segregation aids in risk management and facilitates accurate reporting and reconciliation.

- Monitor and Analyze: Regularly monitor transaction activity associated with each MID and analyze relevant metrics such as transaction volume, chargeback rates, and fraud levels. Proactive monitoring enables merchants to identify anomalies or potential issues promptly.

- Optimize Payment Flows: Continuously optimize payment flows and checkout experiences to minimize friction and maximize conversion rates. Experiment with different payment methods, currencies, and user interfaces to enhance the overall customer experience.

- Stay Informed: Stay abreast of industry trends, technological advancements, and regulatory changes that may impact payment processing and MID management. Engage with payment gateway providers and industry experts to leverage insights and best practices.

In conclusion, Payment Gateway MID serves as a cornerstone of online payment processing, facilitating efficient transaction management, risk mitigation, and settlement for merchants. By understanding the significance of MID and adhering to best practices for its management, merchants can optimize their payment processing operations and enhance the overall customer experience. Embracing the evolving landscape of digital payments and leveraging Payment Gateway MID effectively can pave the way for sustainable growth and success in the digital marketplace.