UPI Solutions Empower High-Risk Merchants

UPI Solutions Empower High-Risk Merchants -In the rapidly evolving digital marketplace, payment solutions have become the backbone of successful business operations. For high-risk merchants, the challenges of securing reliable and efficient payment gateways are even more pronounced. Dream4Pay emerges as a beacon of innovation and security, providing robust Unified Payments Interface (UPI) solutions specifically tailored to meet the needs of high-risk businesses. This blog delves into how Dream4Pay’s UPI solutions empower high-risk merchants, ensuring seamless transactions, enhanced security, and operational success.

Understanding High-Risk Merchants

UPI Solutions Empower High-Risk Merchants – High-risk merchants are businesses that are considered to have a higher risk of fraud, chargebacks, or legal issues. This categorization can be due to several factors:

- Industry Type: Certain industries such as online gambling, adult entertainment, and travel services are inherently considered high-risk.

- Business Model: Subscription services, recurring billing, and businesses with high transaction volumes often fall into the high-risk category.

- Credit History: Poor credit history or past bankruptcy can also classify a business as high-risk.

- Chargeback Rates: A high frequency of chargebacks can mark a business as high-risk.

UPI Solutions Empower High-Risk Merchants – For these businesses, traditional payment processors often impose higher fees, strict compliance requirements, and sometimes outright denial of services. This is where specialized payment solutions like those offered by Dream4Pay come into play.

The Role of UPI in Modern Payment Systems

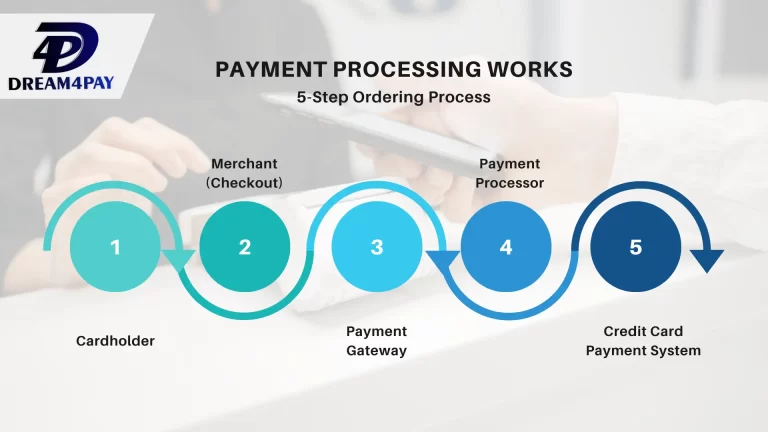

Unified Payments Interface (UPI) has revolutionized the way payments are made and received. Developed by the National Payments Corporation of India (NPCI), UPI allows instant money transfers between bank accounts via mobile devices. Its key features include:

- Immediate Fund Transfer: UPI enables real-time bank-to-bank transactions.

- Ease of Use: Users can link multiple bank accounts to a single UPI ID, simplifying the payment process.

- Interoperability: UPI is designed to work across various banks and financial institutions.

- Security: With two-factor authentication, UPI ensures secure transactions.

UPI Solutions Empower High-Risk Merchants – Given these advantages, integrating UPI into a payment gateway can significantly benefit high-risk merchants by providing them with a fast, secure, and reliable payment solution.

Dream4Pay’s UPI Solutions for High-Risk Merchants

Dream4Pay has positioned itself as a leader in providing UPI solutions tailored specifically for high-risk merchants. Here’s how Dream4Pay empowers these businesses:

1. Enhanced Security Measures

UPI Solutions Empower High-Risk Merchants – Security is paramount for high-risk merchants. Dream4Pay employs advanced security protocols to ensure that all UPI transactions are safe from fraud and cyber threats. This includes:

- Two-Factor Authentication (2FA): Adding an extra layer of security to ensure that only authorized users can complete transactions.

- Encryption: Utilizing state-of-the-art encryption technologies to protect sensitive data during transmission.

- Fraud Detection: Implementing real-time monitoring and machine learning algorithms to detect and prevent fraudulent activities.

2. Reduced Chargebacks

Chargebacks can be detrimental to high-risk businesses, leading to financial losses and strained relationships with payment processors. Dream4Pay’s UPI solutions help reduce chargebacks through:

- Instant Notifications: Immediate transaction alerts help merchants and customers stay informed, reducing the likelihood of disputes.

- Dispute Management: A robust system for managing and resolving disputes quickly and efficiently.

3. Competitive Pricing

High-risk merchants often face exorbitant fees from traditional payment processors. Dream4Pay offers competitive pricing models tailored to the needs of high-risk businesses, ensuring that they can access reliable payment solutions without breaking the bank.

4. Seamless Integration

UPI Solutions Empower High-Risk Merchants – Dream4Pay’s UPI solutions integrate seamlessly with existing e-commerce platforms and websites. This ease of integration ensures minimal disruption to business operations and allows merchants to start accepting UPI payments quickly.

5. Comprehensive Support

Dream4Pay provides comprehensive support to high-risk merchants, including:

- Dedicated Account Managers: Personalized support to address specific business needs and challenges.

- 24/7 Customer Service: Round-the-clock assistance to ensure that any issues are resolved promptly.

6. Multi-Currency Support

UPI Solutions Empower High-Risk Merchants – To cater to a global customer base, Dream4Pay’s UPI solutions support multiple currencies, enabling high-risk merchants to expand their reach and accept payments from customers around the world.

7. Detailed Analytics and Reporting

UPI Solutions Empower High-Risk Merchants – Access to detailed analytics and reporting is crucial for high-risk merchants to monitor their business performance. Dream4Pay provides comprehensive reporting tools that offer insights into transaction history, chargebacks, and other key metrics.

Case Studies: Success Stories with Dream4Pay

Case Study 1: Online Gaming Platform

UPI Solutions Empower High-Risk Merchants – An online gaming platform, classified as high-risk due to its industry type, faced challenges with high chargeback rates and frequent payment processor rejections. By integrating Dream4Pay’s UPI solutions, the platform achieved:

- Reduction in Chargebacks: By 35% within the first six months.

- Improved Customer Satisfaction: Faster and more secure payment options led to higher customer retention.

- Lower Processing Fees: Competitive pricing helped reduce overall payment processing costs.

Case Study 2: Subscription-Based Service

UPI Solutions Empower High-Risk Merchants – A subscription-based video streaming service struggled with recurring billing issues and high transaction volumes. Dream4Pay’s UPI solutions provided:

- Seamless Recurring Billing: Automated UPI payments streamlined the billing process.

- Enhanced Security: Advanced fraud prevention measures reduced instances of fraudulent transactions.

- Scalable Solutions: The service could easily scale its payment processing to handle increasing subscriber numbers.

The Future of High-Risk Payment Processing with Dream4Pay

As the digital economy continues to grow, high-risk merchants will need innovative and reliable payment solutions to stay competitive. Dream4Pay is committed to continuously evolving its UPI solutions to meet the changing needs of high-risk businesses. This includes:

- Investing in Technology: Ongoing investment in cutting-edge technologies to enhance security, efficiency, and user experience.

- Expanding Services: Adding new features and services to support the diverse needs of high-risk merchants.

- Building Partnerships: Collaborating with banks, financial institutions, and technology providers to offer comprehensive payment solutions.

Closure

High-risk merchants face unique challenges in the world of payment processing, but with the right partner, these challenges can be effectively managed. Dream4Pay’s UPI solutions offer high-risk businesses the tools they need to process payments securely, reduce chargebacks, and achieve operational success. By prioritizing security, competitive pricing, and seamless integration, Dream4Pay empowers high-risk merchants to thrive in the competitive digital marketplace.

Whether you operate in online gaming, subscription services, or any other high-risk industry, Dream4Pay is your trusted partner for reliable UPI payment solutions. Contact Dream4Pay today to learn more about how we can help your high-risk business succeed.